Harvard endowment management plays a crucial role in shaping the financial landscape of Harvard University, which boasts an impressive endowment of $53 billion. This remarkable wealth provides the institution with opportunities for strategic development and flexibility but also comes with inherent risks. Effective stewardship of these endowment funds is essential for ensuring that Harvard can meet both immediate needs and long-term goals. Central to Harvard’s financial strategy is the delicate balance between endowment spending and sustainable budget management, allowing for responsible financial health. As such, understanding the intricacies of Harvard University endowment management can shed light on how the university navigates challenges and invests in future growth.

The administration of Harvard’s substantial financial reserves, often referred to as its endowment, is a critical aspect of the university’s overall financial health and strategic planning. As one of the largest and most prestigious endowments in the world, it offers invaluable resources for various educational and research initiatives. The effective management of these assets not only impacts university budget management but also dictates the extent to which the institution can provide financial aid and support innovative programs. Consequently, comprehending the significance of endowment oversight is vital for grasping how Harvard positions itself amidst financial fluctuations and external pressures. Exploring alternative frameworks for managing these resources reveals the complexities involved in maximizing potential returns while minimizing risks in the face of an unpredictable economic environment.

Understanding the Harvard University Endowment

At the heart of Harvard University’s financial strategy lies its endowment, a substantial fund that provides significant financial flexibility for the institution. With a current valuation exceeding $53 billion, the endowment facilitates a wide range of expenses, from faculty salaries to campus maintenance and student financial aid. However, a closer examination reveals that a substantial portion of this endowment is restricted in terms of how it can be allocated, which limits University leaders’ discretion. Consequently, less than 5% of the endowment can be utilized at the University’s discretion, underscoring the complexity and nuances involved in endowment management.

The management of the Harvard endowment is not simply about generating returns; it requires balancing immediate financial needs with long-term sustainability. As economist John Y. Campbell noted, the Framework to understand the budgeting situation encourages careful consideration of how endowment funds are deployed. Spending too much from the endowment in one fiscal year may alleviate current budget constraints but ultimately hampers the University’s financial prospects in subsequent years, demonstrating the importance of strategic endowment spending.

Frequently Asked Questions

What is the current status of the Harvard University endowment?

As of the beginning of the fiscal year in 2025, the Harvard University endowment is valued at a record-setting $53 billion. However, it is important to note that much of this endowment is restricted due to donor conditions and is allocated to various schools within the university, with less than 5 percent being unrestricted.

How does Harvard’s endowment management impact its financial strategy?

The management of Harvard’s endowment is crucial for the university’s financial strategy as it provides flexibility in covering both immediate costs and long-term investment needs. However, reliance on endowment funds for current expenses can strain future resources, making sustainable budgeting essential.

What challenges are associated with Harvard’s endowment spending?

Challenges in Harvard’s endowment spending include managing restricted funds, potential annual distribution adjustments, and external economic factors that could impact revenue. The university has to balance immediate fiscal needs while ensuring long-term financial health.

How does the Harvard Management Company oversee endowment funds?

The Harvard Management Company, which manages the endowment, employs a strategy that targets investment returns of around 8 percent with a payout rate of roughly 5 percent per year. This approach is designed to smooth spending and mitigate volatility in financial performance.

What role does endowment spending play in Harvard’s university budget management?

Endowment spending plays a significant role in Harvard’s university budget management by funding essential operations, research, and generous financial aid programs. However, using endowment funds to cover operational deficits can limit future budgetary flexibility.

What are the implications of economic downturns on Harvard’s endowment?

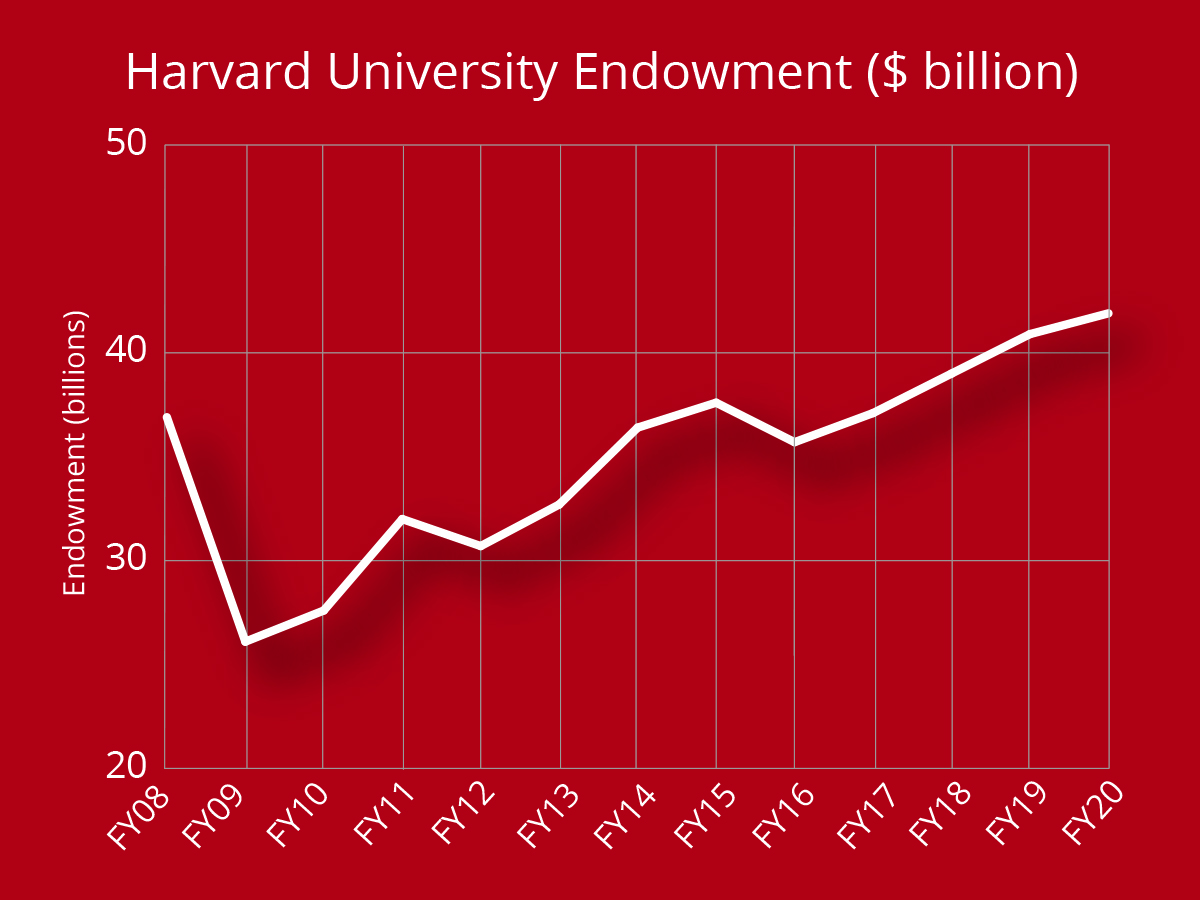

Economic downturns pose risks to Harvard’s endowment, as seen in past experiences like the 2009 financial crisis. In such scenarios, the university might need to increase its endowment distribution to cover deficits, which could strain future operations and investments.

What should Harvard leaders consider when facing potential funding cuts?

Harvard leaders should conduct thorough scenario analyses to assess the impact of potential funding cuts, such as an endowment tax or loss of federal research grants. Understanding these implications is crucial for making informed decisions about future spending and revenue adjustments.

How does Harvard balance the risks and rewards of its endowment investment strategy?

Harvard balances risks and rewards in its endowment investment strategy by smoothing spending to avoid large fluctuations in budget impacts. This cautious approach allows the university to maintain financial stability while capitalizing on potential investment gains.

What lessons can be learned from analyzing Harvard’s Faculty of Arts and Sciences endowment management?

The analysis of Harvard’s Faculty of Arts and Sciences endowment management emphasizes the importance of long-term budgeting frameworks over short-term cash flow fixes, illustrating that strategic planning is necessary to ensure sustainable financial health.

How does donor restriction affect Harvard’s endowment flexibility?

Donor restrictions on Harvard’s endowment can significantly limit flexibility, as funds are often earmarked for specific purposes. This necessitates careful management to align spending with both donor intentions and the university’s overarching financial strategy.

| Key Points | Details |

|---|---|

| Harvard’s Endowment Value | As of this fiscal year, Harvard’s endowment is valued at $53 billion, but most of it is donor-restricted and designated for specific uses. |

| Restricted Funds | Less than 5% of the endowment is unrestricted, meaning most funds are committed to specific schools or projects. |

| Financial Flexibility & Risks | Endowments can provide financial security but using them for immediate needs can jeopardize future resources. |

| Management Challenges | Current endowment use strategies include adjusting payout rates and borrowing against assets. However, this creates future budget constraints. |

| Economic Volatility | Traditional models assume stable returns and inflation, but economic reality can lead to significant risks and fluctuations. |

| Need for Strategic Planning | University leaders need to consider potential economic scenarios and impact on both spending and revenue. |

Summary

Harvard endowment management presents a complex balancing act between immediate needs and long-term sustainability. With an impressive endowment of $53 billion, the university faces challenges due to restrictive donor conditions and an increasing dependency on endowment distributions to cover operational deficits. Given the volatile economic landscape and potential disruptions to revenue streams, it is crucial for Harvard to adopt strategic planning frameworks that ensure financial stability without compromising future growth. As the institution navigates these challenges, careful stewardship of the endowment will be essential for maintaining its legacy and fulfilling its academic mission.